Introduction

What if I told you that everything you’ve heard about tariffs—from the breathless headlines to the so-called expert takes—is either incomplete, misleading, or flat-out wrong? Yep, the corporate media loves a good economic boogeyman, and tariffs are often cast as either heroic shields against foreign exploitation or dastardly villains destroying the economy.

But here’s the truth: It’s way more complicated than that. And I’m about to show you why.

You’ve probably heard politicians say, “We’re bringing back jobs by slapping tariffs on China and protecting American businesses!” Sounds good, right? The problem is, history and data show this simply isn’t how tariffs work. In reality, tariffs act like an invisible tax on YOU, making everything from groceries to cars to washing machines more expensive while doing little to bring jobs back.

Shocking Facts About Tariffs (And Who Really Pays for Them)

Before we dive deep, let’s start with some cold, hard facts—the kind that make you stop and go, “Wait… what!?”

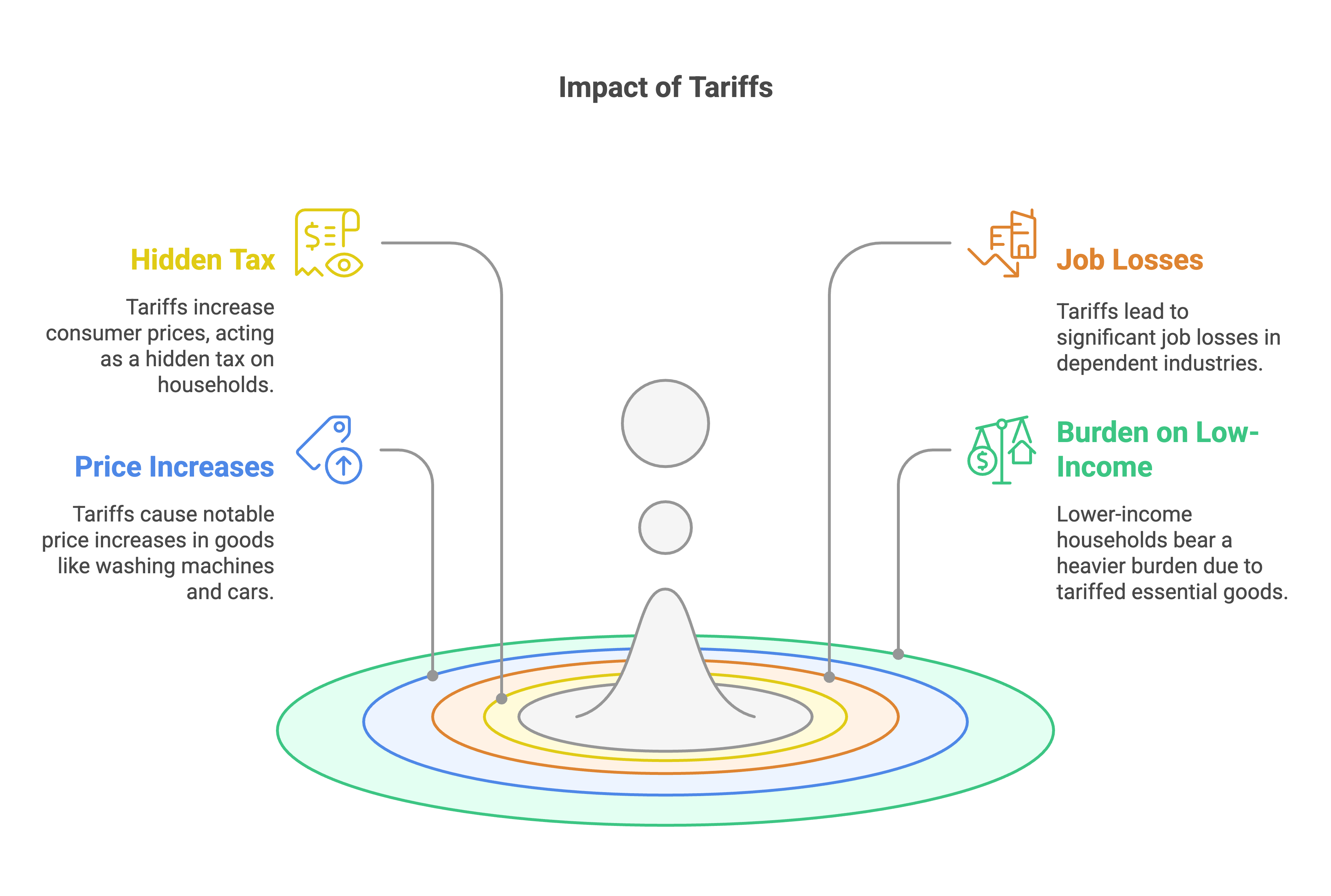

- Tariffs act as a hidden tax on YOU. The average American household paid an extra $1,300 per year due to tariff-driven price increases between 2018 and 2020.

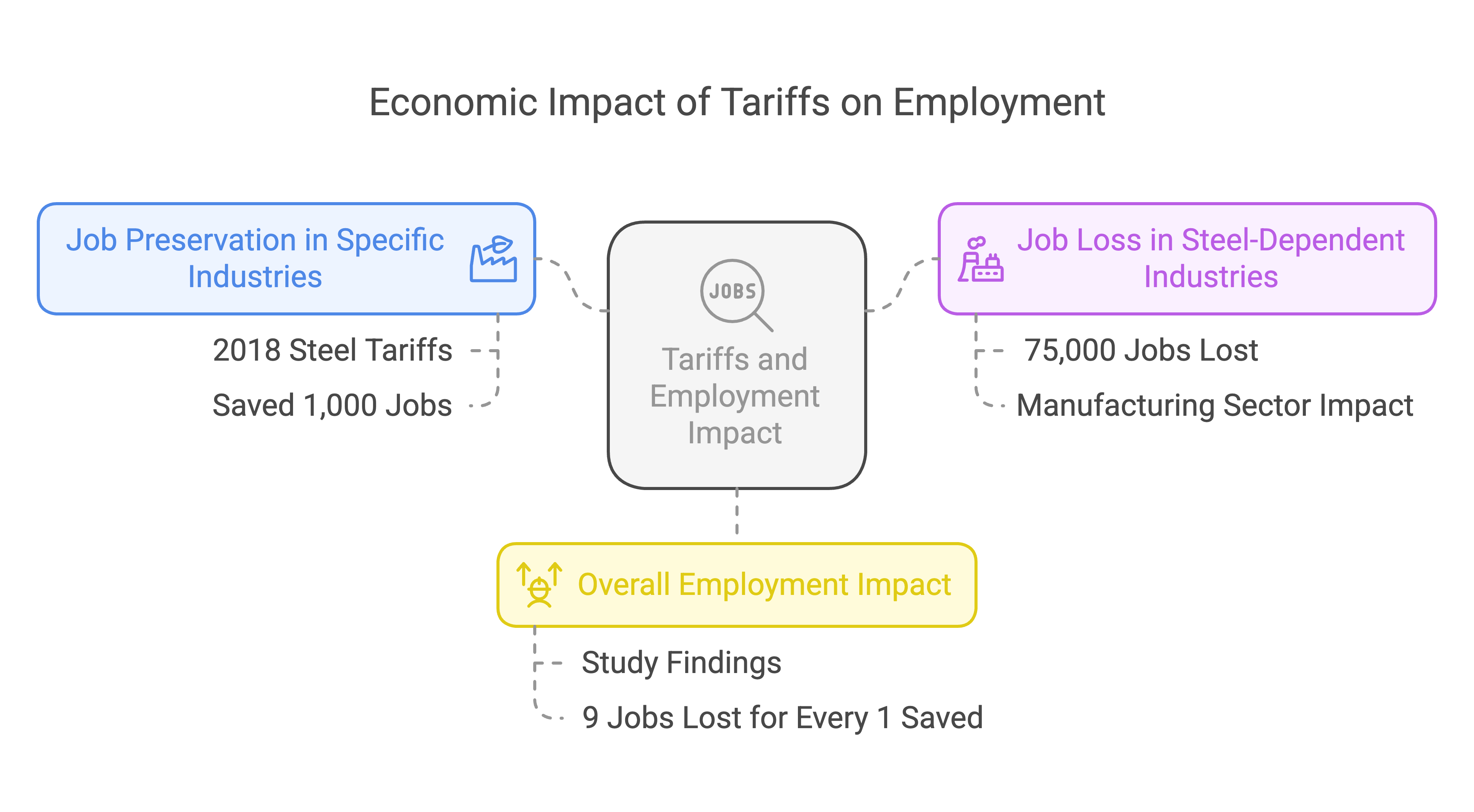

- Job losses outweigh job gains. In the 2018 steel tariffs, 1,000 steel jobs were created—but 75,000 jobs were lost in industries that rely on steel (automakers, construction, appliance manufacturing).

- Tariffs on washing machines alone increased the price of each unit by $86.

- Car prices jumped by $3,000 on average because of higher costs from steel tariffs.

- Lower-income Americans bear the biggest burden. Tariffs hit essential goods like food, appliances, and clothing—things lower-income households spend a higher percentage of their income on.

Who Pays for Tariffs? (Spoiler: It’s Not Foreign Countries)

There’s a common myth that foreign countries “pay” the tariffs—but that’s not how it works. Tariffs are imposed on importers, who then pass the cost down to businesses and consumers.

| Group | How They’re Affected |

|---|---|

| Importers | Pay the tariff upfront but pass the cost onto businesses and consumers |

| Businesses | Raise prices or cut costs (often by laying off workers) |

| Consumers | Pay higher prices at checkout |

This isn’t speculation—these are real numbers, backed by economic studies. And in this guide, I’m bringing the receipts to prove what’s really happening when tariffs are imposed.

I do a much deeper dive on this subject over on Substack that you should read to see who wins and loses. Click here to read the post.

Farmers: The Silent Victims of the Trade War

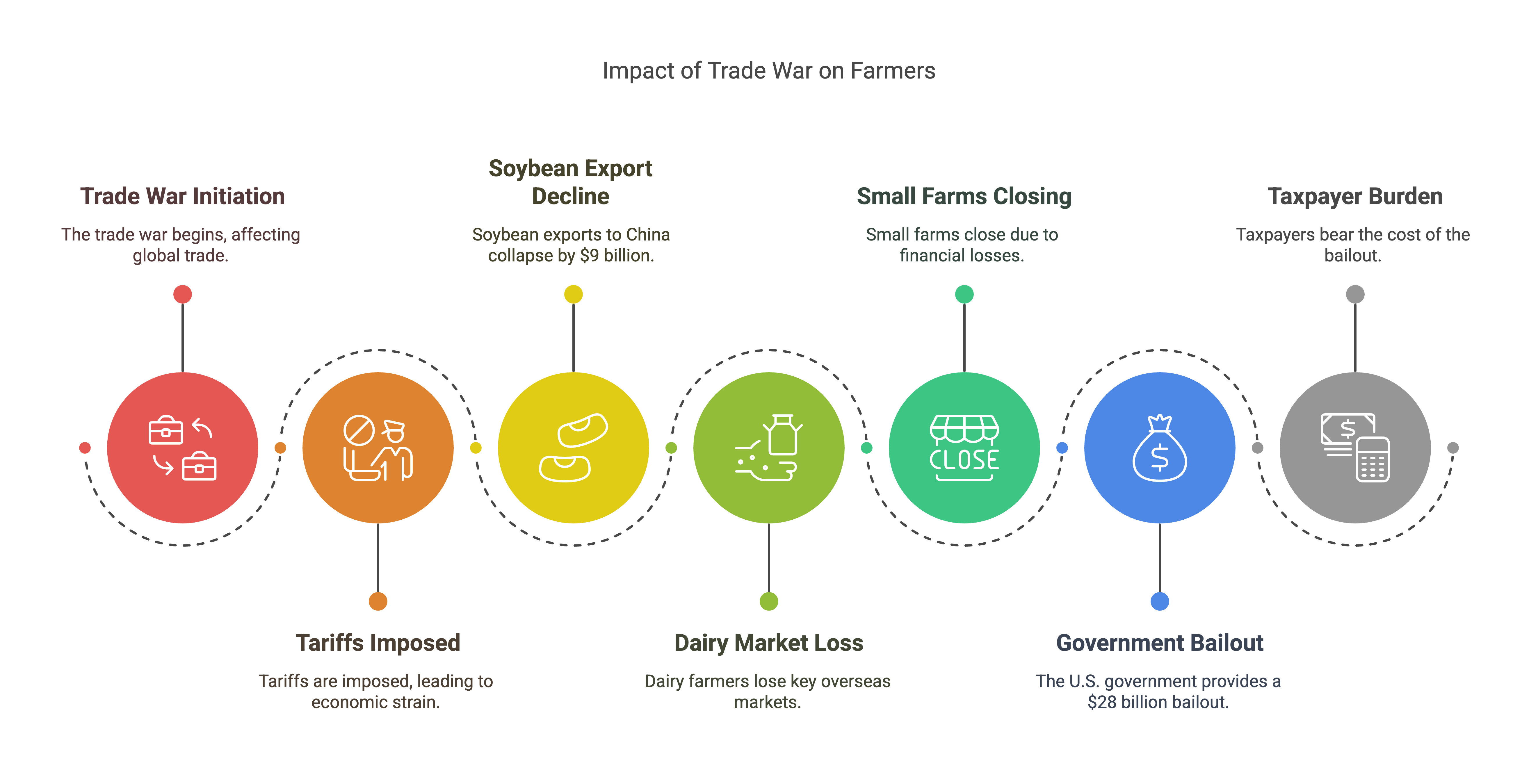

If you think tariffs only hit big corporations, think again. Farmers have been on the frontlines of the trade war, and they’re getting pummeled.

- Soybean exports to China collapsed by $9 billion due to retaliatory tariffs.

- Dairy farmers lost key overseas markets, leaving surplus milk and falling prices.

- Small farms are closing at an alarming rate, as they can’t afford to absorb the financial losses.

- The U.S. government bailed out farmers with $28 billion to offset the damage—but that’s your tax dollars being used to fix a problem tariffs created in the first place.

Tariffs were supposed to help struggling industries, but instead, they crippled farmers and forced the government to clean up the mess.

1. What Are Tariffs?

At their core, tariffs are taxes on imported goods. When a government imposes tariffs, it forces importers to pay extra fees before their goods can enter the country. The logic behind tariffs usually falls into three categories:

- Protect Domestic Industries – Make foreign goods more expensive so consumers buy local instead.

- Generate Government Revenue – Before income taxes existed, tariffs were one of the primary ways governments funded themselves.

- Punish Other Countries – Tariffs can be used as economic weapons in trade wars.

Sounds simple, right? The problem is, the real-world consequences rarely match the intentions.

2. The History of Tariffs: Lessons from the Past

If history has taught us anything about tariffs, it’s that they usually backfire. Here’s a look at some of the biggest tariff moves in history and the chaos they unleashed.

Smoot-Hawley Tariff Act (1930): A Catastrophic Mistake

- Passed during the Great Depression, this law raised tariffs on over 20,000 goods.

- Over 1,000 economists begged President Hoover not to sign it.

- Global trade plummeted by 65%, making the Depression even worse.

- Other countries retaliated, leading to a trade war spiral.

Verdict: One of the worst economic policy moves in U.S. history.

The Tariff of 1828 (“Tariff of Abominations”)

- Purpose: Protect Northern industries from foreign competition.

- Consequence: Southern states, reliant on imported goods, suffered greatly and started talking about secession decades before the Civil War.

Reagan-Era Tariffs on Japan (1980s)

- The U.S. hit Japanese automakers with tariffs to protect American car manufacturers.

- Japan’s response? They moved production to the U.S. and beat the tariffs entirely.

- The Big Three (GM, Ford, Chrysler) still struggled because they focused on gas-guzzlers while Japan made efficient cars.

Verdict: Japanese companies adapted and won. The U.S. auto industry still struggled.

George W. Bush’s 2002 Steel Tariffs

- Imposed 30% tariffs on imported steel to protect U.S. steelmakers.

- Result? Prices skyrocketed for U.S. manufacturers that needed steel (automakers, construction firms).

- More jobs were lost in steel-consuming industries than saved in steel production.

Verdict: The tariffs were removed after just 21 months. A failed experiment.

3. How Tariffs Work: The Economic Mechanics

A tariff is just a tax, but the way it ripples through the economy makes it especially harmful.

Here’s a simple breakdown:

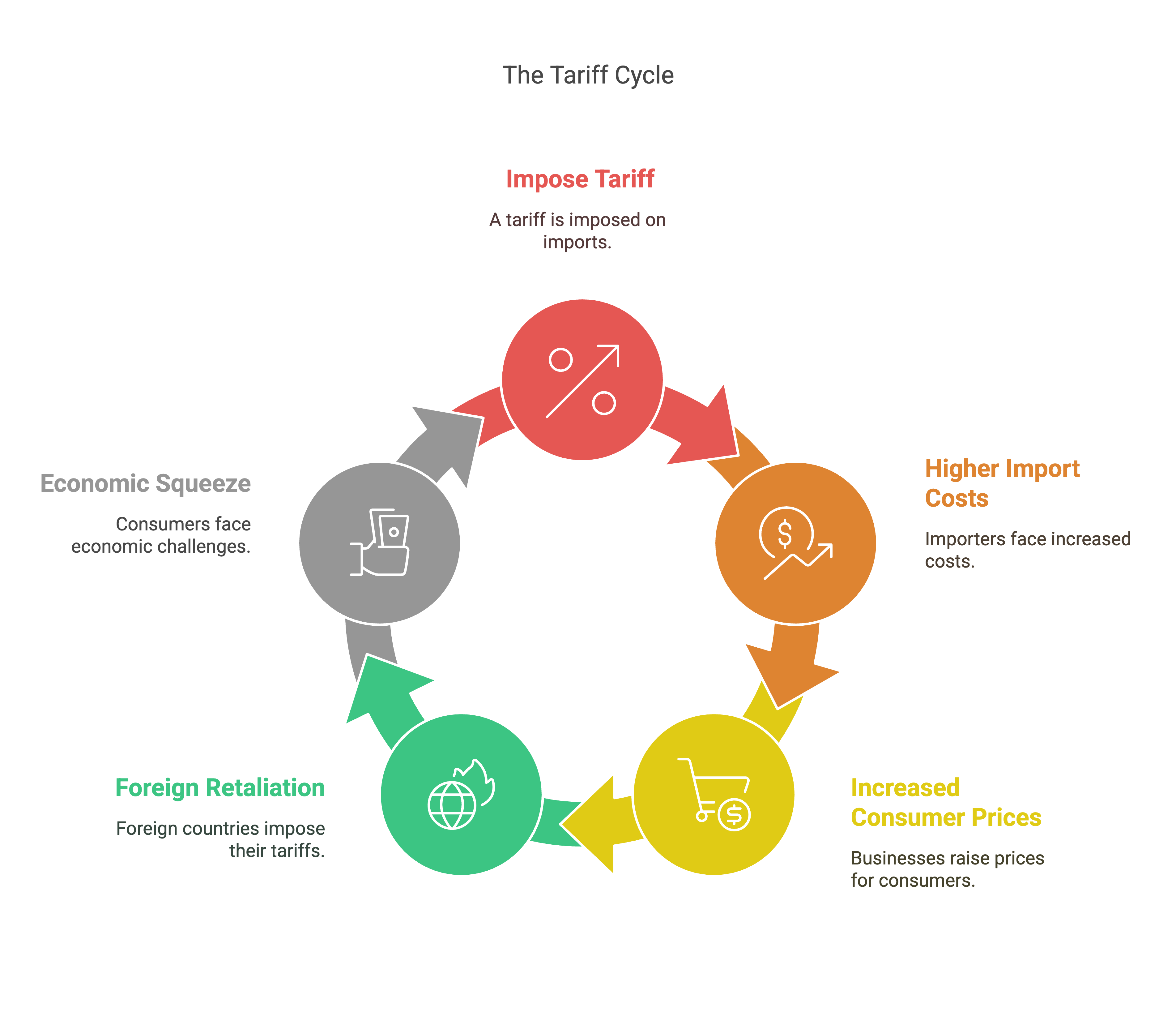

- A tariff is imposed – Let’s say the U.S. adds a 25% tariff on imported steel.

- Importers pay the tax – U.S. companies that rely on steel (e.g., Ford, GM, Boeing) pay higher prices for the materials they need.

- Businesses pass the cost to consumers – To stay profitable, companies raise prices on cars, appliances, and other products.

- Foreign countries retaliate – China, Canada, and the EU impose tariffs on U.S. goods, making it harder for American farmers and manufacturers to sell abroad.

- Consumers get squeezed – Prices go up, jobs are lost, and economic growth slows.

Different Types of Tariffs

- Ad Valorem Tariffs – A percentage-based tax (e.g., a 10% tax on all imported goods).

- Specific Tariffs – A fixed fee per unit (e.g., $50 per imported car).

- Compound Tariffs – A mix of both (e.g., $10 per imported laptop plus 5% of its value).

While tariffs sound like a way to protect American jobs, in reality, they often increase costs, shrink industries, and hurt consumers.

4. The Broader Economic Impact of Tariffs

Tariffs don’t operate in a vacuum—they ripple across the entire economy. Let’s break down their real-world effects.

Inflation and Consumer Prices

- When tariffs raise the cost of imports, prices go up for consumers.

- A 10% tariff on Chinese imports in 2019 increased the average cost of goods by $172 per U.S. household.

- 2018 steel tariffs raised car prices by an average of $3,000 per vehicle.

Supply Chain Disruptions

- Modern supply chains are global, so tariffs disrupt multiple industries at once.

- Example: The 2018 tariffs on Canadian lumber made new homes in the U.S. $9,000 more expensive.

Retaliatory Tariffs and Trade Wars

- Countries don’t just sit back and take tariffs—they hit back.

- China’s retaliation against U.S. soybean farmers in 2018 wiped out $9 billion in exports.

- Europe hit back with tariffs on bourbon, motorcycles, and jeans, targeting American industries.

Job Market Effects

- Tariffs sometimes save jobs in one industry but kill jobs in others.

- 2018 steel tariffs saved about 1,000 steel jobs but killed 75,000 manufacturing jobs in steel-dependent industries.

- A study found that for every job saved by tariffs, 9 jobs were lost elsewhere.

5. Industry-Specific Breakdown

Different industries react differently to tariffs. Let’s look at some key sectors.

Agriculture

- Farmers often get caught in the crossfire when other countries retaliate.

- 2018 China tariffs on U.S. soybeans caused a $9 billion drop in exports.

- The government had to bail out farmers with $28 billion in subsidies to offset losses.

Retail & Consumer Goods

- Walmart and Target warned that tariffs on Chinese goods would force price hikes on everything from clothing to electronics.

- Consumers felt it at the checkout line, paying more for basic necessities.

Technology & Electronics

- Laptops and tablets got hit with price increases of $120 per unit due to 2018 tariffs.

- Smartphone prices rose by $70 after new trade restrictions.

Automobiles

- Tariffs on steel raised vehicle costs by an average of $3,000.

- U.S. car exports dropped by 15% after China’s retaliatory tariffs.

6. Tariff Blunders Throughout History: When Good Intentions Go Bad

Tariffs don’t just exist in theory—they’ve played out in the real world, often with disastrous results. Let’s break down some of the most infamous case studies of U.S. tariffs and their unintended consequences.

The 2009 U.S. Tire Tariffs and Their Backfire Effect

Context:

- In 2009, the Obama administration imposed a 35% tariff on Chinese-made tires to protect American tire manufacturers.

- The goal was to save American jobs and reduce reliance on Chinese imports.

What Happened:

- Jobs saved in the tire industry: ~1,200.

- Cost to U.S. consumers due to higher tire prices: ~$1.1 billion.

- Cost per job saved: ~$900,000 per job (yep, you read that right).

- China retaliated by imposing tariffs on U.S. poultry, causing $1 billion in lost exports for American chicken farmers.

Verdict: The tariffs failed—they saved a handful of jobs but cost consumers far more in higher prices, and farmers suffered due to retaliatory tariffs.

2018 Steel Tariffs: Short-Term Gain, Long-Term Pain

Context:

- In 2018, President Trump imposed 25% tariffs on imported steel and 10% on aluminum, aiming to boost U.S. steel production.

What Happened:

- Steel production jobs gained: ~1,000.

- Jobs lost in steel-consuming industries: ~75,000.

- Cost per manufacturing job saved: ~$650,000.

- U.S. manufacturers reported higher costs, leading to layoffs and production slowdowns.

Verdict: The tariffs helped steelmakers in the short term but harmed industries that rely on steel, from automakers to appliance manufacturers.

The Cost of the U.S.-China Trade War (2018-2020)

Context:

- The U.S. imposed $360 billion in tariffs on Chinese goods, and China retaliated with $110 billion in tariffs on U.S. exports.

What Happened:

- Estimated job losses due to trade war: 245,000.

- Increase in annual costs for the average U.S. household: ~$1,300.

- Soybean exports to China collapsed, costing American farmers billions.

Verdict: Instead of strengthening the economy, the trade war caused higher prices, job losses, and economic uncertainty.

7. The Myth That Tariffs Increase American Prosperity

A common argument for tariffs is that they will increase wages, boost manufacturing, and bring back jobs. But history tells a very different story.

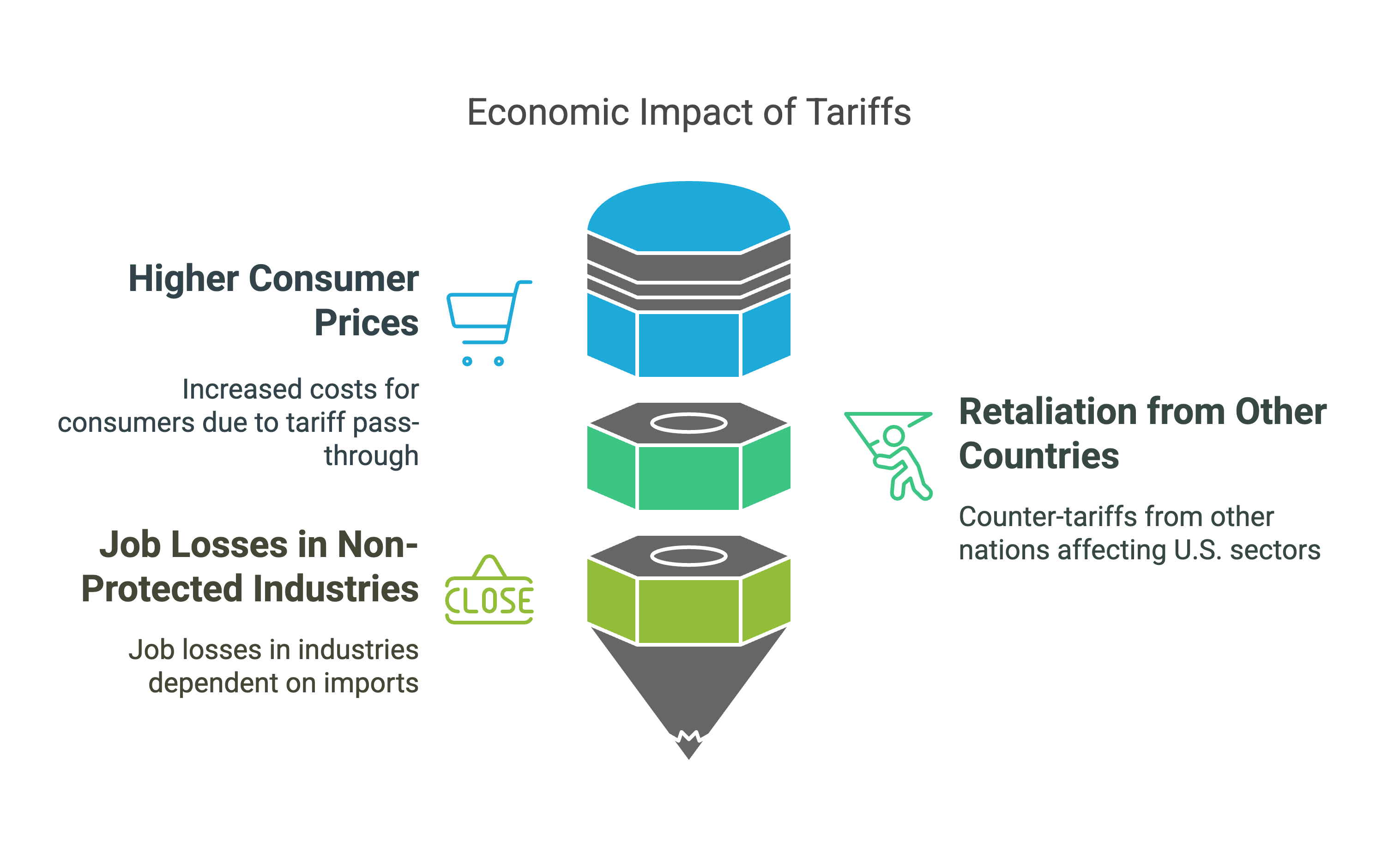

What Happens When Tariffs Are Imposed?

- Consumers pay higher prices – The cost of goods increases as businesses pass on tariff costs.

- Retaliation from other countries – The U.S. faces counter-tariffs, hurting farmers, manufacturers, and exporters.

- Job losses in non-protected industries – While a few jobs may be saved in one sector, far more are lost in industries that rely on imports.

Key Example: The 2018 Steel Tariffs

- The tariffs helped 1,000 steelworkers but harmed 75,000 workers in steel-consuming industries.

- Every major automaker raised prices, passing costs onto consumers.

Reality Check: Instead of boosting wages and jobs, tariffs often increase costs and shrink industries.

8. Why Tariffs Fail to Create Jobs: The Hard Economic Reality

Tariffs vs. Automation

- Most manufacturing job losses in the U.S. aren’t due to trade—they’re due to automation.

- Even if tariffs eliminated all foreign competition, companies would still invest in robotics rather than hire more workers.

Tariffs Can’t Reverse Globalization

- Many products labeled as “Made in the USA” still contain foreign components.

- Example: American cars use parts from Mexico, Canada, and China—tariffs on those materials raise costs.

Reality Check: Tariffs don’t bring jobs back—they just make things more expensive.

9. Hidden Costs of Tariffs for the American Consumer

Higher Prices on Everyday Goods

- 2018 washing machine tariffs increased prices by $86 per unit.

- New car prices increased by $3,000 due to steel tariffs.

- Laptop and tablet prices rose by $120 due to tariffs on Chinese imports.

Tariffs Act Like a Hidden Tax

- The average U.S. household paid $1,300 more per year due to tariff-related price hikes.

- Businesses cut costs elsewhere, often through job cuts.

Reality Check: Tariffs don’t make goods cheaper—they make everything more expensive.

10. Crystal Ball Economics: What Experts Predict About Tariffs

What Do Economists Say About Current Tariff Threats?

- Tax Foundation (2024 Study) – If all proposed tariffs are enacted, U.S. GDP could decline by 0.43% annually.

- Trade Partnership Report – Over 1 million U.S. jobs could be lost due to retaliatory tariffs.

- Oxford Economics (2023 Analysis) – Tariffs increase consumer prices and reduce U.S. exports by 6%.

How Tariffs Could Impact the 2025 Economy

- Inflation would rise as businesses pass costs onto consumers.

- Job losses would outnumber job gains as higher production costs force layoffs.

- Global trade could slow down, worsening supply chain issues.

Hidden Costs of Tariffs

| Product | Price Increase Due to Tariffs |

|---|---|

| Washing Machines | +$86 per unit |

| Automobiles | +$3,000 per vehicle |

| Construction Materials | +$9,000 per new home |

| Electronics | +$120 per laptop/tablet |

Reality Check: Every major economic study predicts that tariffs will reduce growth, increase prices, and cost jobs.

11. The Role of the WTO and International Trade Agreements

The World Trade Organization (WTO) and other trade agreements exist to prevent the kind of economic chaos that tariffs create. When countries slap tariffs on each other, it often spirals into a trade war that harms everyone involved.

How the WTO Regulates Tariffs

- The WTO sets rules for fair trade between nations.

- Countries agree to limit tariffs and resolve disputes through negotiations instead of retaliation.

- The WTO allows tariffs only in certain cases, such as anti-dumping measures or national security concerns (which the U.S. has used to justify steel tariffs).

When the U.S. Breaks WTO Rules

- In the past, the U.S. has imposed tariffs that violate WTO agreements, leading to authorized retaliation from other countries.

- Example: When the U.S. imposed steel tariffs in 2018, the WTO ruled against them, and Europe was allowed to hit back with tariffs on American exports.

What Happens If Countries Ignore the WTO?

- If the WTO loses credibility, trade disputes escalate into economic warfare.

- Countries might stop negotiating and start imposing tariffs freely, causing global trade slowdowns and higher consumer prices.

Reality Check: The WTO and trade agreements exist for a reason—they prevent economic self-destruction.

12. Policy Alternatives: Smarter Solutions to Trade Issues

Instead of relying on tariffs, the U.S. could strengthen its economy and workforce in smarter ways.

Better Trade Enforcement Without Tariffs

- Targeted penalties – Instead of broad tariffs, the U.S. can focus on specific companies engaged in unfair trade.

- Work with allies – Partnering with the EU, Canada, and Japan to pressure trade violators is more effective than unilateral tariffs.

Invest in Workforce Development

- Instead of blocking foreign competition, the U.S. could train workers in advanced manufacturing and automation.

- Tax credits for companies that keep jobs in the U.S. would be more effective than punishing foreign competition.

Boost Domestic Manufacturing Through Incentives

- Instead of making imports more expensive, make domestic production cheaper.

- Offer tax breaks for U.S. factories to stay competitive instead of using tariffs that raise prices.

Reality Check: Tariffs are a blunt instrument. Smarter policies support American jobs without punishing consumers.

13. The Future of Tariffs: Trends and Predictions

What Will Happen If Tariffs Increase?

- Higher inflation – Prices will rise on cars, electronics, and home goods.

- More retaliation from China, the EU, and Canada – Farmers and manufacturers will be hit hardest.

- Global trade slowdown – Supply chain disruptions will worsen.

The Rise of Selective Tariffs

- Future tariffs may target specific companies (like Huawei) instead of entire countries.

- This approach reduces collateral damage to American consumers.

Reality Check: The future of tariffs depends on politics—but if history is any guide, broad tariffs will only make things worse.

14. Challenge: Who Really Pays for Tariffs?

Many people believe that foreign countries pay for tariffs—but that’s not true. The cost is passed down to American consumers and businesses.

Breakdown of Who Pays for Tariffs

| Group | How They’re Affected |

|---|---|

| Importers | Pay the tariff upfront but pass the cost onto businesses and consumers |

| Businesses | Raise prices or cut costs (often by laying off workers) |

| Consumers | Pay higher prices at checkout |

Examples of Tariff Costs Passed to Consumers

- 2018 washing machine tariffs: Prices rose $86 per unit.

- Automobile tariffs: New car prices increased by $3,000 per vehicle.

- Electronics tariffs: Laptops and tablets increased by $120 per unit.

Reality Check: Tariffs are just hidden taxes—and you are the one paying.

15. Conclusion: The Hard Truth About Tariffs

Tariffs sound like a quick fix to trade problems, but history shows they do more harm than good.

Do You Have a Question You'd Like Help With? Contact Debt Coach Damon Day. Click here to reach Damon.

Key Takeaways:

✅ Tariffs make everything more expensive. From cars to groceries, consumers end up paying more.

✅ Job losses outweigh job gains. For every job saved in a protected industry, more jobs are lost in industries that rely on imports.

✅ Retaliatory tariffs hurt American exports. Farmers, manufacturers, and retailers all suffer when other countries fight back.

✅ There are better ways to compete. Instead of blocking trade, we should invest in workforce training and incentivize domestic production.

The Final Word

If tariffs worked, history would show us a long list of success stories—but instead, we have a track record of failure.

So next time someone tells you tariffs will bring back American jobs, ask them: What’s the cost to the American consumer? Because at the end of the day, it’s not foreign countries paying the price—it’s you.

What You Can Do Next

💡 Share this guide with anyone who still thinks tariffs help the economy.

💬 Join the conversation—drop a comment with your thoughts on tariffs.

📩 Subscribe for more economic insights.

Let’s talk about real solutions—not economic myths. 🚀

And to learn who wins in all of this, read my Substack post here.