Ever feel like lenders are speaking a foreign language when they mention your debt-to-income ratio (DTI)? Yeah, me too—at least, before I learned what it actually means. Turns out, it’s not as complicated as it sounds.

Your debt-to-income ratio (DTI) is just a fancy way of saying, “How much of your income goes toward debt payments?” Lenders care about this number because it tells them if you can handle more debt—or if you’re already juggling too many financial balls.

But here’s the thing: understanding your DTI isn’t just for lenders—it’s for you. It’s like checking your car’s gas gauge before a road trip. If it’s too high, you might run out of steam before reaching your financial goals.

So, let me walk you through exactly what it is, why it matters, and how you can lower yours faster than you might think.

Hi, I’m Steve Rhode, the Get Out of Debt Guy. I’ve been helping people like you break free from debt for decades. My goal is to make confusing financial topics—like debt-to-income ratios—simple and easy to understand, so you can make informed decisions and regain control of your money.

🧠 What Is a Debt-to-Income Ratio (DTI)?

Your debt-to-income ratio is the percentage of your monthly income that goes toward paying debt.

Think of it like ordering pizza: if half your paycheck goes toward debt payments, it’s like giving half your pizza to your creditors. And let’s be real—who wants to share that much pizza?

Lenders use DTI to decide if you can afford more debt. But even if you’re not applying for a loan, this number can tell you a lot about your financial health.

📊 How to Calculate Your Debt-to-Income Ratio

The formula sounds like something from high school math class, but trust me—it’s easy:

DTI = (Total Monthly Debt Payments ÷ Gross Monthly Income) × 100

Example:

Let’s say Jake earns $5,000 a month before taxes. Here’s what he pays monthly:

- Car loan: $400

- Credit cards: $300

- Student loans: $250

- Personal loan: $200

Total Monthly Debt: $1,150

DTI Calculation:

1,150 divided by 5,000 × 100 = 23%

What it means:

- Jake spends 23% of his gross income on debt.

- Lenders might think: “Okay, he’s doing fine.”

- But if that number were closer to 50%, they’d start sweating—and so should Jake.

🎯 What Is a Good Debt-to-Income Ratio?

Here’s a simple cheat sheet:

| DTI Range | What It Means | Impact on Borrowing |

|---|---|---|

| Below 36% | Awesome | You’re in great shape for most loans. |

| 36% to 43% | Good | Mortgage lenders like you here. |

| 44% to 50% | Risky Territory | Lenders might raise an eyebrow or two. |

| Above 50% | Uh-oh | Time to tackle that debt before applying for anything. |

🏡 Front-End vs. Back-End DTI: What’s the Difference?

If you’re applying for a mortgage, lenders split your DTI into two parts:

- Front-End DTI: Just your housing costs (mortgage, taxes, insurance).

- Back-End DTI: Housing costs plus every other debt (credit cards, car loans, student loans—everything).

Why it matters:

- Lenders like to see your front-end DTI under 28%.

- Back-end DTI? Keep it under 43% to improve your chances of getting approved.

🔍 Why Your Debt-to-Income Ratio Matters (Even If You’re Not Getting a Loan)

💸 1. It Affects Loan Approvals and Interest Rates

Lenders use your DTI like a financial vibe check. If your ratio is low, they’re more likely to approve you and give you a better interest rate.

Story:

Jessica and Tom were excited to buy their first home. They had solid jobs and decent credit scores—but their 47% DTI got them denied. They hadn’t realized how much their car payments were dragging them down. After focusing on paying off their smaller, high-payment debts, their DTI dropped to 38% in a year. The next time they applied? Approved.

⚖️ 2. It’s a Personal Financial Check-Up

Your DTI tells you if your debt load is manageable—or if you’re just one surprise bill away from panic.

Story:

Mark always paid his bills but felt like he was stuck in a financial hamster wheel. When he calculated his DTI, it was 53%. No wonder he felt stressed. By tracking his spending for a month, he found hundreds going toward unused subscriptions. Canceling those and attacking a $250/month personal loan first brought his DTI down to 40% in less than a year.

😌 3. Peace of Mind (Because Debt is Emotional)

Debt isn’t just numbers—it’s the weight of knowing part of your paycheck is already spoken for. Lowering your DTI gives you breathing room.

Story:

Robert had a 60% DTI and panic attacks whenever he opened his bank app. After working with Damon Day, a debt coach who helped him prioritize high-payment, low-balance debts, he cleared two loans in six months. His DTI dropped to 42%, and so did his anxiety.

💡 How to Lower Your DTI (Without Losing Your Mind)

1. 🎯 Pay Off Debts with the Highest Payments and Smallest Balances First

Forget about interest rates for a second. If you want to drop your DTI fast, focus on debts with:

- High monthly payments and

- Low balances (so you can knock them out quickly).

Example:

Jake had these debts:

| Debt | Balance | Monthly Payment |

|---|---|---|

| Car Loan | $3,000 | $400 |

| Credit Card | $7,000 | $150 |

| Furniture Loan | $900 | $200 |

He focused on paying off the $900 furniture loan first since it had a high payment and a small balance. In three months, that $200 payment was gone—and his DTI dropped by 4%.

2. 💼 Make More Money (Even Temporarily)

Look, I get it—if it were easy to make more money, you’d already be doing it. But even short-term side gigs can give your DTI a boost.

Story:

Rachel started dog-walking on weekends, earning $300/month. She put every penny toward her $2,000 personal loan (monthly payment: $250). Six months later, with some extra effort, that loan was gone, and so was 5% of her DTI.

3. 🚫 Hold Off on New Debt

Are you tempted to upgrade your car or buy that shiny new fridge on credit? Hit the brakes—at least until your DTI is under control.

Story:

Carlos almost bought a truck with a $600 monthly payment when his DTI was already 46%. He waited, paid off his $5,000 credit card balance instead, and lowered his DTI to 35%. The next year, he bought that truck—but with a better loan and less stress.

4. 🧾 Track Your Spending for 30 Days

Budgets are guesses; spending plans are reality. Track every dollar for a month, and you’ll see exactly where your money’s leaking out.

Story:

Leah tracked her spending and found she was paying $250 for apps and subscriptions she barely used. Canceling them helped her pay off a $1,000 loan three months sooner, dropping her DTI from 50% to 42%.

Do You Have a Question You'd Like Help With? Contact Debt Coach Damon Day. Click here to reach Damon.

5. 🧠 Get Help If You Need It

Sometimes, you just need a guide. Damon Day, a seasoned debt coach, helps people create custom plans to lower their DTI without cookie-cutter solutions. Visit DamonDay.com if you want personalized advice that actually works.

Story:

Angela spent years paying down her high-interest credit cards but saw little progress with her DTI. Damon helped her switch focus to a car loan with a $500 payment but only $2,000 left. Three months later, her DTI dropped 6%—and she could finally breathe.

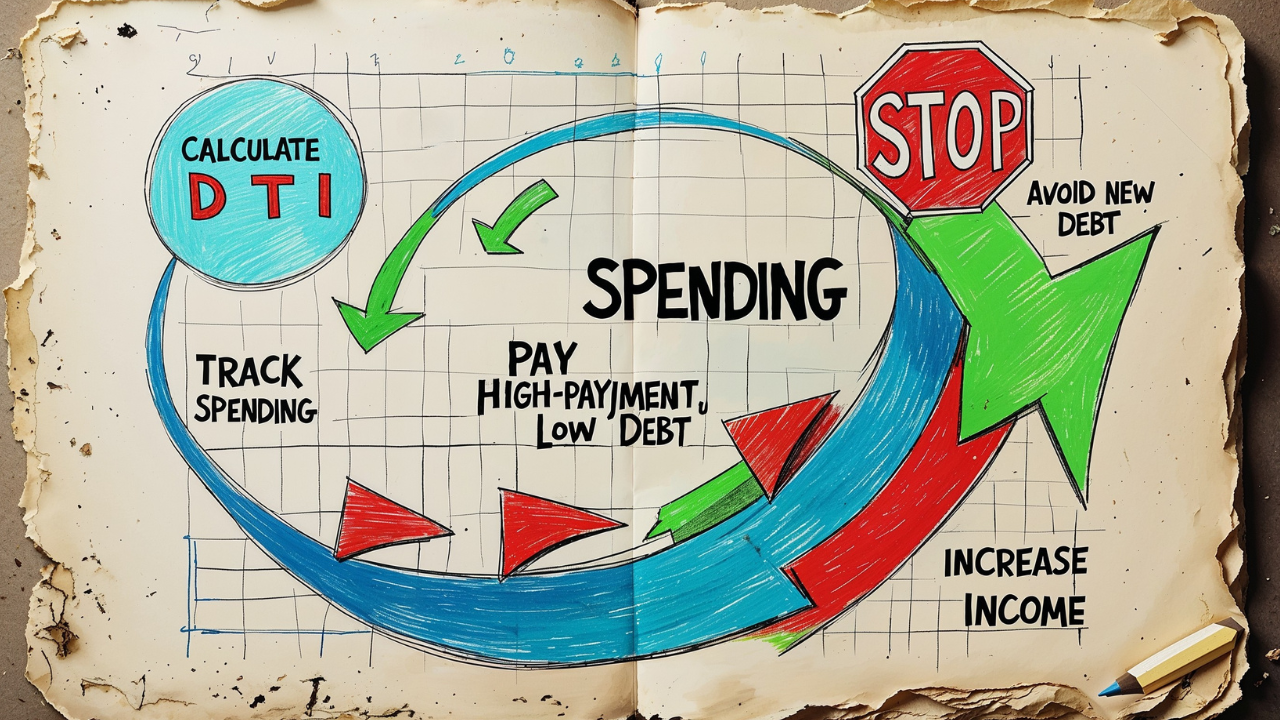

🛠️ Your Simple Debt-to-Income Action Plan

| Step | Action | Why It Works |

|---|---|---|

| Calculate DTI | Use the formula above | Know your starting point. |

| Track spending | 30 days, every dollar | Find hidden money leaks. |

| Target high-payment debts | Start with small balances | Lower DTI faster with quick wins. |

| Avoid new debt | Hold off on big purchases | Keeps DTI from creeping up again. |

| Increase income | Even temporarily | Extra cash accelerates your progress. |

🚀 Next Steps: Take Control of Your Financial Future

Understanding your debt-to-income ratio is like turning on a flashlight in a dark room. It won’t magically erase your debt, but it’ll show you where to go next.

So here’s what to do:

- Calculate your DTI.

- Track your spending for 30 days.

- Target those high-payment, low-balance debts.

And if you need help, don’t go it alone. Contact Damon Day for no-nonsense advice from someone who’s helped thousands of people escape the debt trap.

Want more tips like this? Subscribe to GetOutOfDebt.org to stay in the loop and learn more tricks to master your money.