Zelle didn’t disappear—but the app sure did.

If you opened the Zelle app recently and found it bricked, you’re not alone.

After quietly sunsetting its standalone app on June 30, 2025, Zelle has officially pulled the plug—and it wasn’t just because people weren’t using it. The real story? Scams, lawsuits, and a growing backlash against how the platform was being used (and abused).

🧯 Zelle Still Exists—Just Not as a Standalone App

Let’s clear up the confusion: Zelle the service still works—it’s just no longer available as its own app.

If your bank supports Zelle—and most major ones do—you can still send and receive money through your bank’s mobile app.

✅ No need to delete your Zelle account

✅ Just log in to your bank app and use Zelle there as usual

💣 Why the App Was Shut Down: Fraud, Lawsuits, and Public Pressure

Zelle’s app wasn’t just unpopular—it became a fraud hotspot.

Because Zelle transfers are:

- Instant

- Direct from your bank account

- Irreversible

…it made life way too easy for scammers.

🎭 Fake buyers, phony landlords, online sellers with “too good to be true” deals—they all took advantage. And when victims reported it, banks often said:

“Sorry. You authorized the payment.”

That led to:

- Class action lawsuits

- Congressional scrutiny

- Headlines about scam victims losing thousands with no recourse

💬 One reader told me they lost $750 trying to rent an apartment. They sent the deposit through Zelle. No keys. No landlord. No refund.

The Zelle app became a liability. So Early Warning Services (Zelle’s owner) quietly shut it down and now routes all users through banks where security and fraud monitoring are more centralized.

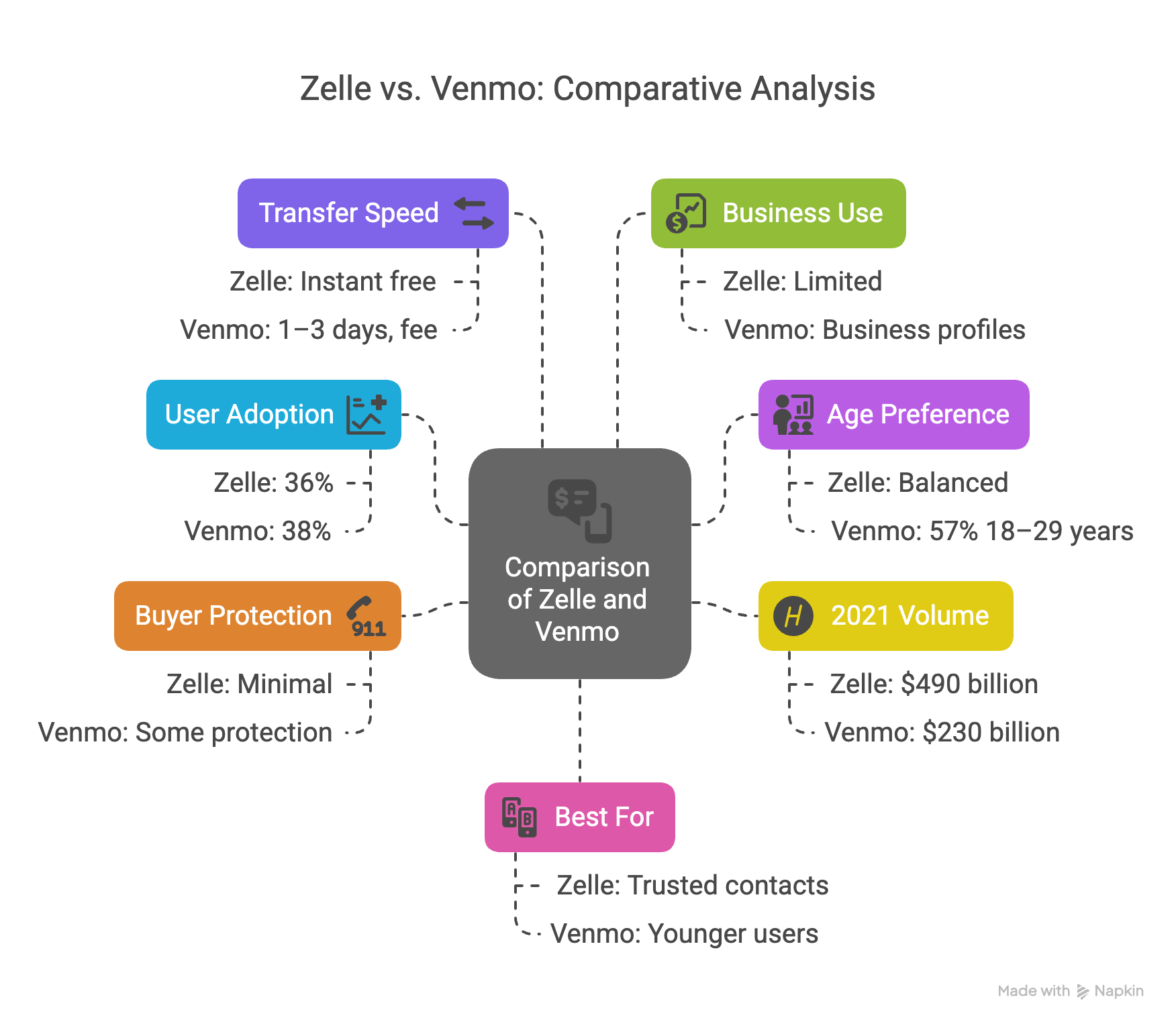

📊 Zelle vs. Venmo: How Do They Really Compare?

Here’s a clean, updated breakdown of how Zelle stacks up against Venmo now that the app is gone:

| Category | Zelle (via bank app) | Venmo |

|---|---|---|

| User Adoption (2022) | 36% of U.S. adults used Zelle | 38% of U.S. adults used Venmo |

| Age Preference | More balanced across age groups | 57% of 18–29-year-olds reported using Venmo |

| 2021 Volume | $490 billion processed | $230 billion processed |

| Buyer Protection | Minimal—no refunds if you’re scammed | Offers some purchase protection for goods/services |

| Transfer Speed | Instant and free via linked bank account | 1–3 days standard; 1.75% fee for instant transfers |

| Business Use | Limited, depends on bank | Business profiles + seller tools (1.9% + $0.10 fee) |

| Best For | Trusted contacts, rent splits, bank-to-bank use | Younger users, online purchases, business transactions |

🛑 Important:

While Zelle’s owners have claimed fraud rates are low, consumer experience tells a different story. Zelle offers little to no protection if you’re tricked into sending money—making it riskier in practice, even if the data doesn’t capture that.

(Source: Pew Research, Forbes, American Banker, CFPB)

🧬 Who Owns Zelle (And Why That Matters)

Zelle is owned by Early Warning Services, a company backed by:

- Bank of America

- JPMorgan Chase

- Wells Fargo

- Capital One

- PNC Bank

- Truist

- U.S. Bank

It launched in 2017 as the banks’ answer to Venmo. While it moved money faster than almost any platform out there, it also lacked the safety net that many users now expect.

🧠 Did You Know?

💡 In 2023, fraud losses linked to peer-to-peer apps like Zelle, Venmo, and Cash App totaled over $629 million, according to the CFPB.

Zelle doesn’t offer a “cancel” button or any buyer protection if you’re tricked into sending money.

📲 What You Need to Do Now

If you were using the Zelle app, here’s your new game plan:

✅ Use your bank’s app to access Zelle

✅ Delete the Zelle app (it no longer works)

✅ Don’t use Zelle for online deals—only send to people you know

✅ Download your old transaction records if you need them for taxes or disputes

🧵 TL;DR: What You Need to Know

- Zelle shut down its standalone app on June 30, 2025

- The service still works, but only through your bank’s app

- The shutdown followed years of fraud, lawsuits, and regulatory pressure

- Never use Zelle with strangers—there’s no fraud protection

- For purchases, use options like Venmo, PayPal, or a credit card for added safety

📣 How to Share This

Want to help someone avoid getting scammed?

🧠 “Zelle didn’t shut down—but its app did, and fraud was a big reason. Here’s what to do next before someone takes your money.”

➡️ [https://getoutofdebt.org/175019/]

Copy. Paste. You might save someone $500 (or more).

🧭 Final Thoughts from a Trusted Friend

Zelle moved fast. And when it worked, it was magic.

Do You Have a Question You'd Like Help With? Contact Debt Coach Damon Day. Click here to reach Damon.

But let’s be honest: speed without protection is a scammer’s best friend.

That’s why I always say—use Zelle like cash. If you wouldn’t hand someone physical money with no receipt, don’t send it through Zelle either.

If you’ve ever felt duped, scammed, or just unsure who to trust when it comes to money, I’ve been there. That’s why I built GetOutOfDebt.org—to help people just like you make smart, safe decisions without shame.

📘 And if you’ve ever been taken by a scam, here’s a book I wrote that I think will help:

👉 How to Get Out of Debt Without Getting Scammed and What to Do if You Have Been

💬 Your Turn:

Ever sent money through Zelle and instantly regretted it? Drop your story in the comments. You might save someone from making the same mistake.

And before you go, boop that like button, subscribe, and check out GetOutOfDebt.org for more smart, no-BS financial tools.