The Consumer Financial Protection Bureau published information in the Federal Register today that shows how screwed up student loan programs are.

The data and facts released are enough to make you give up hope the student loan programs can ever be fixed. Indeed not fixed with one-time forgiveness.

I will do my best to summarize the highlights of the 29-page document, but you can read the full findings here.

Keep in mind as you read this report that eviscerates student loans that these are not my words. These are the findings of the CFPB, a federal government agency.

Private Student Loans

Banks, non-profits, nonbanks, credit unions, state-affiliated organizations, institutions of higher education, and other private entities hold an estimated $128 billion in these student loans, as reported to the national consumer reporting companies. Private student loans include traditional in-school loans, tuition payment plans, income share agreements, and loans used to refinance existing Federal or private student loans.

Recently, institutions and other private actors started offering new private student loan products branded as “income share agreements” (ISAs). At least several dozen postsecondary institutions directly offer income share agreements (ISAs), which require consumers to pledge a given percentage of their incomes over a specified period. The repayment process for ISAs may result in consumers realizing very large APRs or prepayment penalties that may be illegal under the Truth In Lending Act or State usury caps.

Postsecondary institutions sometimes provide loans directly to their students; this practice is known as institutional lending.3 Aggregate data on institutional lending are limited. Underwriting requirements and pricing of institutional loans vary widely, ranging from low- interest rate, subsidized loans that do not require co-signers to unsubsidized loans that accrue interest during and after the student’s enrollment and do require borrowers to meet underwriting standards or obtain qualified co-signers. At the same time, many institutions also extend credit for postsecondary education through products like deferred tuition or tuition payment plans. Student loans and tuition billing plans may be managed by the institutions themselves or by a third-party service provider that specializes in institutional lending and financial management. Supervisory observations suggest that some institutional credit programs have delinquency rates greater than 50 percent.

Additionally, students may withdraw from their classes before completing 60 percent of the term, triggering the return of a prorated share of title IV funds to Federal Student Aid (FSA), known as “return requirements.” Institutions of higher education often charge tuition even where students do not complete 60 percent of the term. When a student withdraws from classes without completing 60 percent of the term, the institution often refunds the title IV funds directly to FSA and, in turn, bills students for some or all of the amount refunded to FSA, since the school is maintaining its tuition charge for the classes. Institutions handle these debts in a variety of ways, but many offer payment plans and other forms of credit to facilitate repayment. In aggregate, these debts, called “Title IV returns,” can total millions of dollars. Supervisory observations indicate that some of these repayment plans can include terms requiring repayment for more than four years.

Federal Student Loans

Government-backed and guaranteed student loans account for 93 percent of outstanding student loan balances.

The Federal student loan portfolio has more than tripled in size since 2007, reflecting rising higher education costs, increased annual and aggregate borrowing limits, and increased use of Parent and Grad PLUS loans. Annual Grad PLUS origination volume has more than quadrupled in that time, expanding from $2.1 billion to an estimated $11.6 billion during the 2020-21 academic year.

Federal student loans suffer high default rates. As of March 2022, approximately $171 billion in outstanding title IV loans were in default. This represents nearly 11 percent of outstanding balances but 19 percent of Federal student loan borrowers ‒ a figure that would surely be higher but for the federally owned loan payment suspension.

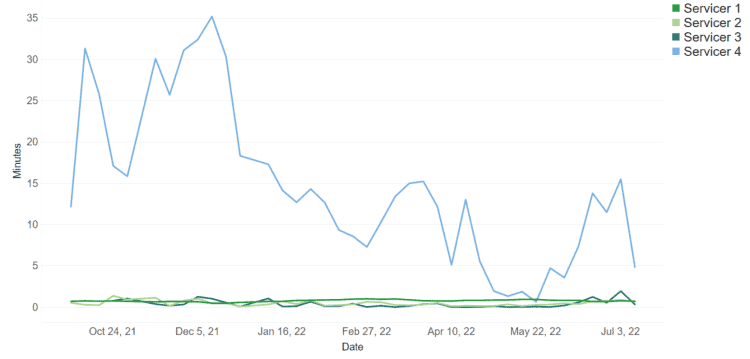

ED contracts with several companies to service Direct and ED-owned FFELP loans. When one of these companies decides to stop servicing loans, the accounts are transferred to another contractor. As shown in Figure 2, the recent departures of Granite State and PHEAA/FedLoan Servicing resulted in the transfer of millions of borrower accounts among the remaining Federal loan servicers.

Where a borrower’s data has become lost or corrupted as a result of poor data management by a particular servicer, subsequent transfers may result in servicers sending inaccurate periodic statements, borrowers losing progress toward forgiveness, and borrowers having difficulty in rectifying past billing errors.

Institutional Lending

Where higher education institutions extend credit, the dual role of lender and educator provides institutions with a range of available collection tactics that leverage their unique relationship with students. For example, some postsecondary institutions withhold official transcripts as a collection tactic. Institutions often withhold transcripts from their students who are delinquent on debt owed to the institution, while also requiring new students to provide official transcripts from schools they previously attended. Collectively, this industry practice creates a circumstance in which a formal official transcript is necessary for students to move from one school to another, creating a powerful mechanism to enforce payment demands even when consumers seek to attend a competitor school. Consumers who cannot obtain an official transcript could be locked out of future higher education and certain job opportunities.

Examiners found that institutions engaged in abusive acts or practices by withholding official transcripts as a blanket policy in conjunction with the extension of credit. These schools did not release official transcripts to consumers that were delinquent or in default on their debts to the school that arose from extensions of credit. For borrowers in default, one institution refused to release official transcripts even after consumers entered new payment agreements; rather, the institution waited until consumers paid their entire balances in full. In some cases, the institution collected payments for transcripts but did not deliver those transcripts if the consumer was delinquent on a debt.

Examiners found that institutions took unreasonable advantage of the critical importance of official transcripts and institutions’ relationship with consumers.

Since many students will need official transcripts at some point to pursue employment or future higher education opportunities, the consequences of withheld transcripts are often disproportionate to the underlying debt amount. Additionally, faced with the choice between paying a specific debt and the unknown loss associated with long-term career opportunities of a new job or further education, consumers may be coerced into making payments on debts that are inaccurately calculated, improperly assessed, or otherwise problematic.

Supervision determined that blanket policies to withhold transcripts in connection with an extension of credit are abusive under the Consumer Financial Protection Act and directed institutional lenders to cease this practice.

Federal Student Loan Transfer Data Screwed Up

Notable findings include:

- Many servicers reported that the initial set of information they received during the transfer was insufficient to accurately service loans. In some cases, important account information was missing or provided in an unusable format. For example, examiners identified inaccurate information about certain consumers’ monthly payment amounts, due dates, and payment plans. The root cause of many of these discrepancies was one servicer’s failure to include current repayment schedules – data showing future expected monthly payments based on consumers’ repayment plans – for many accounts in the transfer. This error occurred for hundreds of thousands of accounts.

- Transferee and transferor servicers reported different numbers of total payments that count toward IDR forgiveness for some consumers.

- One servicer sent statements to more than 500,000 consumers that presented inaccurate information about the borrower’s next due date and, separately, the date Federal student loans were set to return to repayment.

- One servicer placed certain accounts into transfer-related forbearances following the transfer, instead of the more advantageous CARES Act forbearances.

- Multiple servicers experienced significant operational challenges in managing the transfers at the same time they were implementing major program changes. The payment pauses and extensions, PSLF waiver, and transfers drove increased call volume and applications for payment relief. Some servicers were inadequately staffed, making them unable to effectively manage this volume. As shown in Figure 3, call wait times and average processing time for payment relief increased significantly.

- Some accounts transferred with inaccurate capitalization or paid ahead status. These errors caused the transferee servicer to misrepresent consumers’ payment amounts or due dates.

Unfair and Abusive Teacher Loan Forgiveness Applications

Examiners found that servicers engaged in unfair acts or practices when they wrongfully denied TLF applications in three circumstances: (1) where consumers had already completed five years of teaching, (2) where the school was a qualifying school on the TCLI list, or (3) when the consumer formatted specific dates as MM-DD-YY instead of MM-DD-YYYY, despite meeting all other eligibility requirements.

These wrongful denials resulted in substantial injury to consumers because they either lost their loan forgiveness or had their loan forgiveness delayed. Consumers who are wrongfully denied may understand that they are not eligible for TLF and refrain from resubmitting their TLF applications. Consumers could not reasonably avoid the injury because the servicer controlled the application process. Finally, the injury was not outweighed by countervailing benefits to consumers or competition.

Consumers reasonably rely on servicers to act in their interests, and this servicer encouraged consumers to consult with their representatives to assist in managing their accounts, including on its websites where it provided information about TLF. Further, it was reasonable for consumers who are applying for TLF to rely on their servicer to act in the consumers’ best interests because processing forgiveness applications is a core function for student loan servicers, and they are entirely in control of their evaluation policies and procedures.

Public Service Loan Forgiveness

By 2018, Congress came to understand that many consumers working in public service would never receive PSLF benefits due the complexities of higher education finance and eligibility requirements. At that time, the PSLF program had discharged loans for only 338 consumers despite receiving 65,500 applications.

At a minimum, many applicants had a fundamental misunderstanding about the program terms. In response, Congress authorized additional funding to extend the PSLF benefits to Direct Loan borrowers who would be eligible but for repaying under a non-qualifying repayment plan like the Extended or Graduated repayment plans. The Temporary Expanded PSLF (TEPSLF) allowed these consumers that meet certain additional requirements in their last year of repayment to have the balance of their loans forgiven.

Do You Have a Question You'd Like Help With? Contact Debt Coach Damon Day. Click here to reach Damon.

Over the following three years, PSLF and TEPSLF canceled debts for 10,354 and 3,480 consumers, respectively. However, these successful applications continued to be the exception, as more than half a million applications were rejected, including 409,000 from borrowers who had not been in repayment on a Direct Loan for 120 months. These data are explained in part by material misrepresentations by FFELP servicers about critical PSLF terms and application processes.

Unfair Practices of PSLF

Results of Employer Certification Forms (ECFs) and PSLF applications are communicated to consumers through letters telling consumers whether the form was approved or denied and including counts of consumers’ total qualifying payments (QPs) and estimated eligibility dates (EEDs) for reaching the 120 payments required for forgiveness. Examiners identified both wrongful denials and approvals of applications or ECFs. In many cases, the servicer corrected these errors months later, after the consumer complained or the servicer identified the issue. In the sample reviewed, examiners found that the servicer wrongfully approved ECFs where the borrowers had ineligible employment or had loans that were otherwise ineligible. This representation could lead consumers to falsely believe they are accruing credit toward forgiveness and delay taking steps like loan consolidation that could actually make them eligible. Other ECFs were wrongfully denied when representatives erroneously determined the forms had invalid employment dates, were missing an employer EIN, or were otherwise incomplete – when in fact they were not.

Wrongful approvals and denials and incorrect PSLF eligibility information resulted in a substantial injury because the availability of PSLF can substantially impact borrowers’ careers, financial situation, and life choices. Depending on the circumstances, consumers may have committed to additional work with their employers for these months, instead of pursuing other opportunities; made other major financial decisions, such as financing the purchase of a residence or automobile; or delayed consolidation of their FFELP loans. The injury is not reasonably avoidable because borrowers have no choice among student loan servicers, no way to ensure the servicer properly processed these forms and were often not aware of the processing errors. Finally, the injury was not outweighed by countervailing benefits to consumers or competition because there is no direct benefit to consumers or competition created by improper approvals or denials.

Unfair Practice of Excessive Delays in PSLF

Examiners found that at least one servicer engaged in an unfair act or practice when it excessively delayed processing PSLF forms. In some cases, these delays lasted nearly a year. These delays could change borrowers’ decisions about consolidation, repayment plan enrollment, or even employment opportunities. For example, when FFELP loan borrowers apply for PSLF, they are denied because those loans are ineligible, but they are told that a consolidation could make the loan eligible. Therefore, a delay in processing the PSLF form could cause consumers to delay consolidation and delay their ultimate forgiveness date.

Income Driven Repayment Unfair Practies and Acts

Federal student loan borrowers are eligible for a number of repayment plans that base monthly payments on their income and family size. Over the years, the number of IDR programs has expanded, and today several types of IDR plans are available depending on loan type and student loan history. Most recently, ED implemented the Revised Pay As You Earn (REPAYE) for certain Direct student loan borrowers. For most eligible borrowers, REPAYE results in the lowest monthly payment of any available IDR plan. By the end of 2020, more than 12 percent of all Direct Loan borrowers in repayment were enrolled in REPAYE.

Examiners found that servicers engaged in unfair acts or practices when they improperly processed consumers’ IDR requests resulting in erroneous denials or inflated IDR payment amounts. Servicers made a variety of errors in the processing of applications: (1) erroneously concluding that the alternative documentation of income (ADOI) documentation was not sufficient, resulting in denials; (2) improperly considering spousal income that should have been excluded, resulting in denials; (3) improperly calculating AGI by including bonuses as part of consumers’ biweekly income, resulting in higher IDR payments; (4) failing to consider consumers’ spouses’ student loan debt, resulting in higher IDR payments; and (5) failing to process an application because it would not result in a reduction in IDR payments, when in fact it would. These practices caused or likely caused substantial injury in the form of financial loss through higher student loan payments and the time and resources consumers spent addressing servicer errors. Consumers could not reasonably avoid the injury because they cannot ensure that their servicers are properly administering the IDR program and would reasonably expect the servicer to properly handle routine IDR recertification requests.

Parent PLUS, IDR, and PSLF Misrepresentation

Examiners found that servicers engaged in deceptive acts or practices when they represented to consumers with parent PLUS loans that they were not eligible for IDR or PSLF. In fact, parent PLUS loans may be eligible for IDR and PSLF if they are consolidated into a Direct Consolidation Loan. These representations were likely to cause reasonable borrowers considering IDR or PSLF for Parent PLUS loans to forgo taking any future steps to pursue those programs.