Just when you thought prices were finally cooling down and your grocery bill didn’t make you want to cry in the parking lot—bam! Inflation is rolling in like a wrecking ball. And let’s just say, if your wallet had feelings, it would be filing for emotional distress right about now.

Inflation’s Back—And It Brought Friends

Remember that lovely stretch when your $5 coffee somehow morphed into an $8 crime against humanity? Well, get ready for the Encore Tour No One Asked For!

According to the economic crystal ball (a.k.a. those folks with spreadsheets and degrees), inflation was starting to chill at 2.6% in January. But now? Thanks to these shiny new tariffs, we’re looking at another potential 2.2 percentage point spike. That’s economist-speak for “hold onto your pants, things are about to get stupid expensive.”

And the cherry on top? The average American household is about to lose $1,200 in purchasing power this year. That’s a whole vacation—or roughly 150 oat milk lattes—down the drain.

What’s Actually Happening?

That’s how these tariffs work. Goods get hit with fees every time they cross a border. And considering that some auto parts, for example, cross the U.S.-Canada border eight times before becoming a car, you can see how this turns into a game of economic hot potato—but with your money.

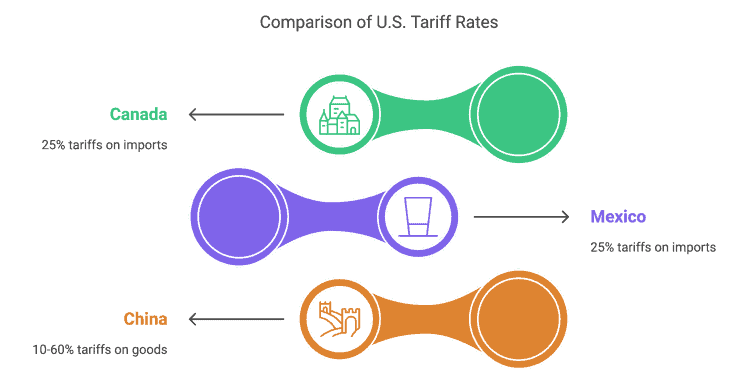

Here’s what we’re dealing with:

- 25% tariffs on Canadian and Mexican imports

- 10-60% tariffs on Chinese goods

- U.S. tariff rates jumping from 2.5% to 13.8% (the highest since before color TV was a thing)

If this keeps up, we might all have to start learning to skateboard because car prices are about to get even more ridiculous.

How This Hits Your Wallet

Tariffs don’t just exist—they get passed down the food chain. And guess where that chain ends? Right at your checkout line.

Here’s how it plays out:

Groceries? More Like Luxury Goods Now.

- 42% of U.S. fruits and veggies come from Mexico—and now they’re 25% pricier. Say goodbye to affordable guacamole.

- Canadian crude oil tariffs mean diesel prices are up 12¢/gallon. So, yeah, your delivery fees just got a little spicier too.

Cars? Just Take Out a Mortgage at This Point.

- New car prices could jump $3,000 minimum, with SUVs rising $9,000+.

- Used cars? Already up 15% since February.

- Car insurance? Up 8%—because apparently, everything has to get more expensive.

Oh, and about 142,000 auto jobs are on the chopping block. So, that’s fun.

Services? They’re Coming for Those Too.

- Healthcare equipment? Up 5-7%—because medical bills weren’t already horrifying enough.

- Retail giants like Target? Already raising prices on avocados and electronics.

- Wages? Rising faster than productivity, which means more businesses will raise prices to keep up.

Who’s Getting Hit the Hardest? (Hint: Not the Rich.)

In a shocking twist that absolutely nobody saw coming, low-income households are feeling this the most:

| Income Level | Extra Annual Costs Due to Tariffs |

|---|---|

| Bottom 20% | $1,020 – $1,140 extra/year |

| Middle 20-40% | $1,080 – $1,200 extra/year |

| Top 5% | $890 – $1,010 extra/year |

Low-income families spend 25% of their income on tariff-affected goods. The top 5%? Just 8%.

So, while billionaires sip their untaxed lattes on private jets, working families are out here rationing baby strollers and fresh produce. “America First” sure has an expensive membership fee.

The Bigger Picture: This Isn’t Just About Prices

We’re not just talking about a couple of extra bucks at the checkout. The entire economy is taking a hit:

- GDP could drop by 0.8% because of these tariffs.

- The Atlanta Fed predicts a 2.8% contraction in Q1 2025.

- The Fed was all set to cut interest rates, but now those chances dropped from 68% to 32%. Translation: Don’t expect relief anytime soon.

The Fed President recently said there are “persistent inflationary pressures from trade policy,” which is central banker code for “Oh crap.”

Any Good News? Maybe…?

On March 5th, there was some whispering about possible tariff relief for auto imports. The stock market jumped on the news like a starving man at a buffet—Ford shot up 2.1%, GM up 4.7%, and Tesla up 1.8%.

But don’t get too excited just yet. At the same time, 24% of businesses said they now expect inflation to be above 4% for the next five years. So, basically, even if the government decides to maybe chill with the tariffs, companies are already planning to charge you more anyway.

Do You Have a Question You'd Like Help With? Contact Debt Coach Damon Day. Click here to reach Damon.

The Bottom Line

These tariffs are setting off a chain reaction that looks a little something like this:

- Supply chain chaos – Reshoring costs estimated at $470B

- Wage-price spiral – Higher wages, but productivity isn’t keeping up

- Inflation expectations rising – And once people expect high inflation, it just… keeps happening

S&P Global predicts real incomes will decline by 2.2% by 2026, meaning we’re all working just as hard but affording less.

So, what now?

Well, if this turns into a full-blown trade war, expect things to get even pricier before they get better. In the meantime, maybe start a backyard garden, brush up on your bike repair skills, and budget like your life depends on it. Because, honestly? Your wallet’s gonna need all the help it can get.

Final Thoughts (And My Personal Survival Plan)

I’ll be over here hoarding avocados and Canadian maple syrup like it’s the apocalypse. If you see me in the Costco parking lot with a cart full of frozen guac, mind your business.

And you? What’s your game plan for surviving this mess? Drop a comment below—I wanna hear your strategies. Oh, and before you go, subscribe to GetOutOfDebt.org. Your future self will thank you.