The Federal Trade Commission just released the seal on actions it took to shut down a debt relief company that has appeared on this site before. – Source

In an announcement made today, the FTC filed a complaint under seal against A to Z Marketing, Apex Members, Apex Solutions, Backend, Expert Processing Center, Smart Funding, William D. Goodrich Attorney, WDG Attorney at Law, Ratan Baid, Madhulika Baid, and William Goodrich.

The FTC asked for and received a temporary restraining order, asset freeze, and the appointment of a receiver. – Source

The scheme halted by the FTC certainly resembles a number of other such similar appearing approaches taken by companies judging by the mailers readers have been sending in through my I Buy Junk Mail program.

It would be difficult to say the observations by the FTC in this particular action were unique or rare.

There appear to be a number of companies that continue to offer advanced fee mortgage modification and rescue services that violate the Mortgage Assistance Relief Services rules. And that appears to be a key point in the FTC action taken.

The Federal Trade Commission filed suit in federal court to halt a mortgage relief scheme that allegedly deceived and preyed on distressed homeowners by charging them $2,000 to $4,000 based on bogus foreclosure rescue claims.

The defendants allegedly falsely claimed they would provide legal help to save consumers’ homes from foreclosure and lower their mortgage payments, then charged them up-front fees in violation of federal law, delivering little or no help, and driving them deeper into debt.

The temporary restraining order signed by the court shuts down the defendants’ websites, freezes their assets, and provides for appointment of a receiver pending trial.

![]() The defendants also marketed their scheme online, through telemarketing calls and with television and radio ads, according to the complaint. The defendants’ websites touted a range of financial services, including bankruptcy advice, credit counseling, and “forensic mortgage audits.” One of the sites described how these “audits” can help consumers hold onto their homes or lower their mortgage payments. It falsely claimed that the “audits” could uncover any “lending violations” committed by lenders, and that the information could be used “to gain leverage in a successful loan modification,” the complaint stated.

The defendants also marketed their scheme online, through telemarketing calls and with television and radio ads, according to the complaint. The defendants’ websites touted a range of financial services, including bankruptcy advice, credit counseling, and “forensic mortgage audits.” One of the sites described how these “audits” can help consumers hold onto their homes or lower their mortgage payments. It falsely claimed that the “audits” could uncover any “lending violations” committed by lenders, and that the information could be used “to gain leverage in a successful loan modification,” the complaint stated.

In reality, however, the defendants generally did not provide the promised loan modification or help consumers avoid foreclosure, either directly or through the “forensic mortgage audits.”

The complaint charges the defendants with violating the Federal Trade Commission Act and with violating the Mortgage Assistance Relief Services Rule, which bans mortgage foreclosure rescue and loan modification services from collecting fees until homeowners have a written offer from their lender or servicer that they deem acceptable.

The complaint also names as defendants Apex Solutions, Inc.; William D. Goodrich, Attorney, Inc.; A to Z Marketing, Inc.; Apex Members, LLC; Backend Inc.; Expert Processing Center, Inc.; and Smart Funding Corp. – Source

Details From Complaint

From at least mid-2010 to present, through operation of the common enterprise, in a nationwide scheme, Defendants have engaged in a course of conduct to advertise, market, sell, provide, offer to provide, or arrange for others to provide MARS, including loan documentation and transaction services, and loan modification services.

Defendants prey on financially distressed homeowners by luring them into membership programs or loan modification services with promises that they will receive legal representation from a real estate attorney who will negotiate with their lenders to save their homes from foreclosure or make their mortgage payments substantially more affordable. In addition to legal representation, Defendants purport to provide consumers enrolled in certain of their programs with forensic loan audits to identify errors in their mortgage loan documents and to ferret out predatory lending practices. Defendants also purport to gather information that attorneys will use to win concessions with lenders. Consumers, however, do not receive the promised services.

Defendants have marketed their services using a number of trade names, including but not limited to, Apex Members, Apex Solutions, McArthur Financial Services, William D. Goodrich, Attorney at Law, WDG, McGoldrick Law Center, Burke Law Center, Cronauer Law Center, Nationwide Law Center, United States Law Center, Interstate Law Group, Top Legal Advocates, and Home Loan Services Law Center.

To support the provision of MARS by these trade names, Defendants rely on a network of support companies, including but not limited to, Defendants A to Z Marketing, Inc., Backend, Inc., Expert Processing Center, Inc., and Smart Funding Corp. These companies, individually or in combination, perform critical functions for the common enterprise, including but not limited to, compiling sales leads of consumers who may be interested in obtaining a home-loan modification, printing and mailing sales information, employing telemarketers to promote the MARS, registering and maintaining websites, and processing consumers’ financial information purportedly to share with the consumer’s lender.

Consumers who agree to pay Defendants’ fee of $2,000 to $4,000 are then typically asked to sign an agreement to allow Client Services, which is a trade name registered and used by Defendant A to Z Marketing, Inc. (which is itself a corporate name not disclosed to consumers), to immediately debit at least a down payment of Defendants’ fee directly out of their accounts. Those who make only a down payment are then required to make additional payments until the full amount is paid.

Starting sometime in 2011 and continuing into 2013, Defendants changed slightly the way they did business. Instead of holding out Defendant William D. Goodrich as an attorney who would represent the consumer, Defendants have established relationships with several attorneys, helping them set up purported law firms to do loan modifications, and then have told consumers that the lead or named attorney, or another attorney at the purported law firm, would represent them. Purported law firms established in this manner include, but are not limited to, the McGoldrick Law Center, the Burke Law Center, and the Cronauer Law Center. To set up these purported law firms, Defendants designed, registered, or maintained websites, provided sales materials and agreements, and provided marketing and backend services. Typically, the lead or named attorney has disassociated him or herself with Defendants within a brief period of time upon learning the true nature of Defendants’ operations. At least one of the websites Defendants established in this manner, for the Burke Law Center, together with the toll-free number displayed there, remained operational into 2013, despite that attorney’s prior disassociation with Defendants.

Also at about this time, Defendants established relationships with other attorneys to create generically named companies purporting to be law firms including, but not limited to, the Nationwide Law Center, the United States Law Center, the Interstate Law Group, and Top Legal Advocates, some or all of which have currently operational websites that Defendants designed, registered, or maintained. These “firms” purport to offer MARS interstate through nearly identical networks of associated attorneys.

Defendants retain operational control of these purported law firms. Defendants retain complete responsibility for compiling sales leads of consumers who may be interested in obtaining a home-loan modification, printing and mailing sales information, employing telemarketers to promote the MARS, registering and maintaining websites, and processing consumers’ financial information purportedly to share with the consumer’s lender.

Consumers interested in Defendants’ MARS from these purported law firms have been typically offered a package of contracts. Included have been:

a. a Mortgage Modification Service Agreement, whereby the lead or named attorney, or another attorney, would agree to represent the consumer in obtaining a loan modification;

b. a release allowing staff at Defendant Expert Processing Center to obtain personal financial information from the consumer’s lender; and

c. an agreement authorizing Client Services (i.e., Defendant A to Z Marketing, Inc.), to withdraw funds from the consumer’s bank account.

The Sales Pitch

Defendants initiate contact with consumers in many ways, including but not limited to unsolicited mailings or flyers, unsolicited outbound telemarketing calls, inbound telephone calls from consumers originating from Defendants’ websites or other marketing materials, and outbound calls to consumers.

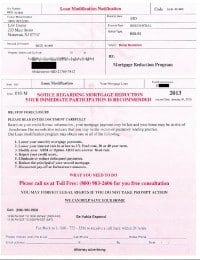

Defendants’ flyers, a typical example of which is attached to this Complaint as Attachment A, are official-looking forms entitled “Loan Modification Notification” and contain file numbers and other identifying numbers preceded by the letters “MOD.” Further down on the form there is a box labeled “Total Loan Amount” with an amount purporting to be the consumer’s outstanding loan amount. The form continues with a notification in bold, all-caps type, informing the consumer:

NOTICE REGARDING MORTGAGE REDUCTION YOUR IMMEDIATE PARTICIPATION IS RECOMMENDED

The notice continues by saying, among other things:

Based on your mortgage lender information and your property profile provided to us you may be qualified for a loan modification. This includes the following:

1. Lower your monthly mortgage payments.

2. Lower your monthly interest rate to as low as 2% fixed rate, 30 or 40 year term.

3. Modify your ARM or Option ARM into a lower fixed rate.

The notice then advises that “YOU MAY FORFEIT LEGAL RIGHTS IF YOU DO NOT TAKE PROMPT ACTION[,]” and WE CAN HELP SAVE YOUR HOME[.]” The notice then provides a toll-free number for a “free consultation.”

An earlier version of this flyer, attached to this Complaint as Attachment B, contains similar information and formatting, but instead of stating “YOUR IMMEDIATE PARTICIPATION IS RECOMMENDED,” it states “YOUR IMMEDIATE PARTICIPATION IS REQUIRED.” It also states that “[t]housands of homeowners have taken advantage of this opportunity and have reduced their monthly mortgage payment by 30-60%.”

Defendants also advertise their mortgage assistance relief services on broadcast media and on the internet. Like the flyers Defendants sent, these include a toll-free number that consumers can call for more information.

Often, Defendants’ websites contain a testimonial section including experiences of what purport to be satisfied customers. One such testimonial states “I just got a call from Mick at your office. He was able to get my mortgage payment cut in half from my lender! I have attached pictures of us in front of our home. Thanks to you, our home is safe and we are FINALLY in a stable financial position.” Another states “[t]hank you for doing such a brilliant job on my mortgage modification. Just 2 months ago, the bank was ready to foreclose and we were looking for a rental. Now, our home is safe and we couldn’t be happier!” Similar testimonials often appear in sales materials Defendants send directly to consumers.

Consumers who receive outbound calls, or who call the toll-free number listed in Defendants’ sales materials or websites, then speak to a representative. In numerous instances, Defendants’ representatives have claimed that Defendant William D. Goodrich, or another attorney, would represent them and negotiate with their lender to obtain a loan modification, and that the attorney would conduct a forensic audit to look for illegalities in the original lending documents to gain leverage with the lender.

In numerous instances, Defendants’ representatives have told consumers that Defendants or Defendants’ affiliated attorneys would get them a loan modification.

In numerous instances, Defendants’ representatives have told consumers that they were guaranteed to obtain a loan modification that would make their mortgage payments substantially more affordable.

In numerous instances, Defendants’ representatives have told consumers that they could have their interest rates reduced to as low as 2% or have their principal balance reduced.

In numerous instances, Defendants’ representatives have told consumers that they should stop paying on their mortgages.

In numerous instances, Defendants’ representatives have told consumers that they should not contact their lenders directly.

Do You Have a Question You'd Like Help With? Contact Debt Coach Damon Day. Click here to reach Damon.

In numerous instances, Defendants’ representatives have told consumers that Defendants or their affiliated attorneys could get consumers a loan modification in a brief period of time, such as a few months or within 60 to 90 days.

Post Contract

Consumers who desire Defendants’ services then sign the contracts provided and authorize Defendants to withdraw an advance fee from their accounts ranging from about $2,000 to $4,000, or a down payment on that amount. Defendants, through Client Services (i.e., Defendant A to Z Marketing, Inc.), then withdraw these fees either in a one-time transfer or in installments.

Typically, consumers who contract with Defendants are assigned to one or more non-attorney customer-service representatives who act as their primary points of contact. Often, consumers attempt to call the representative assigned to them, but are unable to reach a live person without making repeated attempts. Often, consumers find after many months that no progress has been made on their behalf with their lenders.

In numerous instances, consumers who contract with Defendants do not receive legal representation. Although they may be assigned an attorney in a nominal sense, many consumers never meet or speak with Defendant William D. Goodrich, an attorney working for the purported law firms discussed in paragraphs 24 and 25, or any other attorney, much less an attorney in the state where they reside or where the property is located. Moreover, while Defendants lead consumers to believe that an attorney from one of the law centers will represent them, Defendants retain most of the fees paid, and in many cases, fail to inform the law center that a client had been obtained, fail to turn over financial information the client provided, or work on the consumer’s file with little or no attorney involvement, much less the skilled legal advocacy promised.

In numerous instances, consumers who contracted with Defendants have suffered significant economic injury, including paying hundreds or thousands of dollars to Defendants and receiving little or no service in return, going into foreclosure, and even losing their homes.

In numerous instances, after consumers have contracted with Defendants and paid the requested advance fees, Defendants have failed to obtain a loan modification, principal reduction, or other relief to stop foreclosure or make consumers’ mortgage payments substantially more affordable. – Source