Imagine waking up to find that all the rules keeping your bank from charging you $50 every time you sneeze the wrong way have vanished overnight. That’s essentially what’s happening as the Consumer Financial Protection Bureau (CFPB) is being dismantled in early 2025. Led by Acting Director Russell Vought, the agency has been ordered to cease operations, employees have been locked out, and Congress is moving to strip all its funding. This isn’t just a bureaucratic reshuffle—it’s a financial earthquake for everyday Americans.

So, what did the CFPB do, and why does it matter? Let’s break it down.

In what world do people think that if you fire all the consumer protection cops, crime will go down, and scammers will go away?

How the CFPB Actually Helped You (Yes, You)

If you’ve ever had an overdraft fee refunded, a credit card dispute settled in your favor, or a shady payday lender shut down, you can thank the CFPB. Since its creation in 2010 after the financial crisis, the agency has recovered more than $21 billion for consumers. That’s not chump change—that’s billions back into the pockets of people who were scammed, overcharged, or otherwise fleeced by financial institutions.

Here’s what the CFPB accomplished:

- Returned $21 Billion to Consumers – Through enforcement and supervision, the CFPB clawed back money from banks, lenders, and scammy financial operators who played fast and loose with consumer protections. (Source)

- Capped Junk Fees – Just last year, the CFPB finalized rules that would have capped overdraft fees at $5 (down from $35) and limited credit card late fees to $8 (instead of $30-41). These caps alone would have saved Americans about $15 billion per year—but guess what? Those protections are going away.

- Took Down Debt Relief and Credit Repair Scams – Ever seen an ad promising to “erase your bad credit” or “negotiate away your debt for pennies on the dollar”? The CFPB went after these bad actors hard, securing a $2.7 billion judgment against Lexington Law and CreditRepair.com for illegal junk fees. The agency even managed to return $1.8 billion to 4.3 million consumers harmed by these scams. Without the CFPB? Good luck getting that money back. (Source)

- Protected Military Families from Predatory Lenders – Service members, especially those stationed near military bases, have long been targeted by payday lenders charging 100%+ APR interest rates. The CFPB cracked down on these lenders, but with the agency shutting down, expect these shady operations to make a comeback.

Beyond enforcement, the CFPB provided essential financial education, consumer complaint tracking, and research into harmful financial practices. This transparency helped hold financial institutions accountable and empowered consumers with knowledge to avoid common financial traps.

Why States Can’t Fill the Gap

Some argue that state consumer protection agencies can step up, but that’s like expecting a neighborhood watch to replace the FBI. Here’s why state-level enforcement falls short:

Do You Have a Question You'd Like Help With? Contact Debt Coach Damon Day. Click here to reach Damon.

1. State Laws Are a Mess

With no federal oversight, consumer protection turns into a patchwork of inconsistent state laws. That means:

- Consumers in California might get some protection, while those in Texas get none.

- Lenders and debt collectors can set up shop in the least regulated states and operate nationwide with little oversight.

2. States Don’t Have the Resources

The CFPB had around 1,600 employees specializing in everything from payday lending to mortgage fraud. Most state consumer protection agencies have a fraction of that staff—sometimes only a handful of people handling thousands of complaints.

3. No National Coordination

The CFPB helped states go after big financial fraudsters by providing data, legal expertise, and cross-state cooperation. Without it, states will be left scrambling on their own, making large-scale enforcement nearly impossible.

Who Wins When the CFPB Dies? (Hint: Not You)

While everyday Americans get the short end of the stick, some folks are popping champagne.

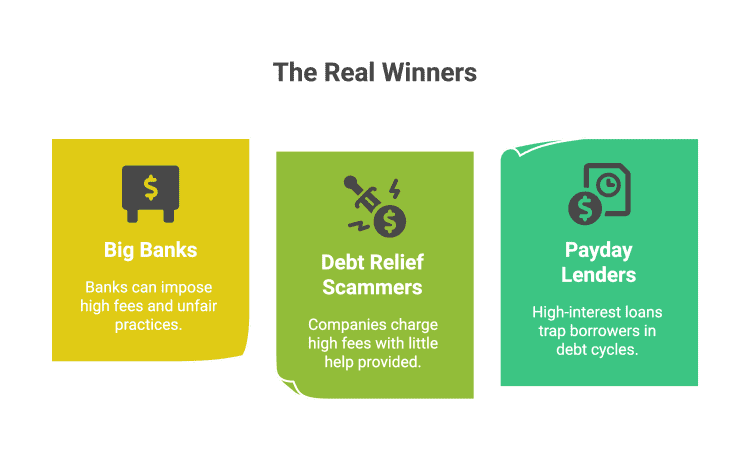

Winners:

- Big Banks & Credit Card Companies – With the CFPB gone, banks can return to $35 overdraft fees, $41 late fees, and sneaky billing practices that the agency had been working to eliminate.

- Debt Relief & Credit Repair Scammers – The Lexington Law crackdown? That’s the last big case you’ll see. These companies are free to charge huge upfront fees and deliver little to no real help.

- Payday Lenders & Subprime Loan Sharks – These folks love high-interest loans that trap people in endless debt cycles. With no CFPB breathing down their necks, expect more 300% APR loans to pop up in low-income neighborhoods.

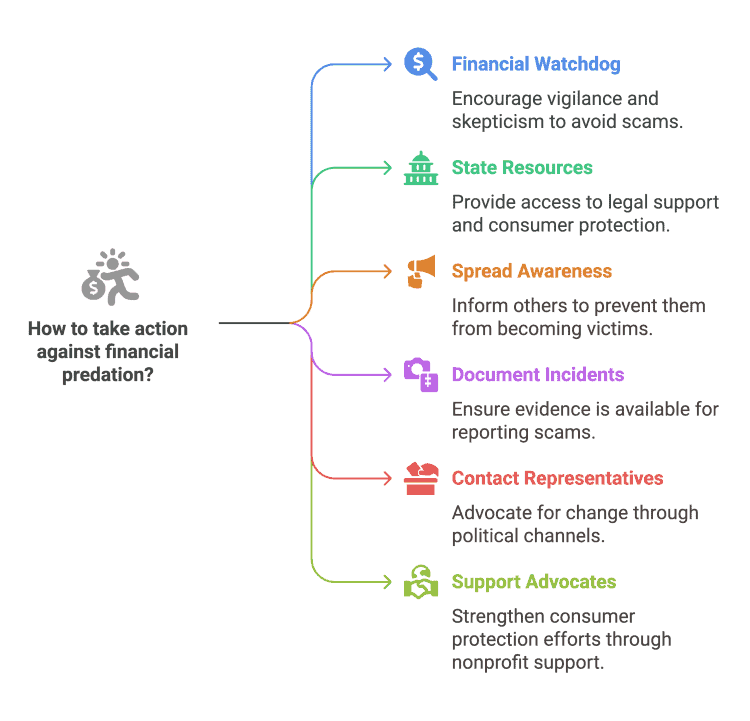

Final Thought: A Future Without a Watchdog

The CFPB wasn’t perfect, but it was the only federal agency solely dedicated to protecting consumers from financial abuse. With its elimination, the burden falls squarely on consumers to fend for themselves in an increasingly predatory financial landscape. The question isn’t whether bad actors will take advantage—it’s how soon and how badly they will.

Without a national watchdog, financial institutions are free to bring back the very practices that led to the 2008 financial crisis. That means higher fees, more predatory lending, and less recourse when consumers get ripped off.

Want to stay on top of consumer protection issues? Subscribe to GetOutOfDebt.org for more updates, and drop a comment below—what financial horror stories have you experienced? Let’s talk about it.